sacramento county tax rate

Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax.

Sacramento County Transfer Tax Who Pays What

The minimum combined 2022 sales tax rate for Sacramento California is.

. 2021-2022 compilation of tax rates by code area code area 03-035 code area 03-036 code area 03-037 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00249 los rios coll gob 00249 los rios coll gob 00249 sacto unified gob 00918 sacto unified gob 00918 sacto unified gob 00918. Our Mission - We provide equitable timely and accurate property tax assessments and information. The overall property taxes in California are below the national average at 73.

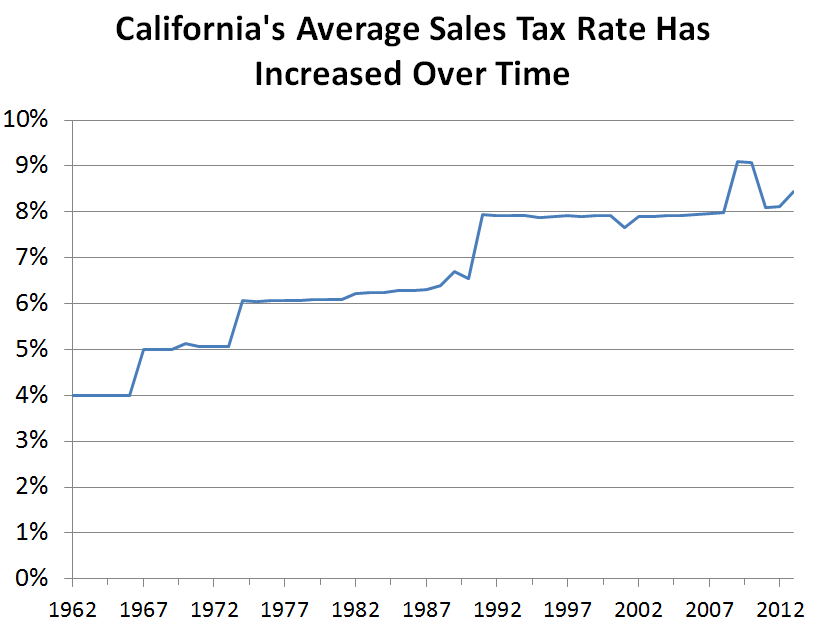

The national rate on the other hand is at 107. To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page. Tax Collection and Licensing.

Request Full and Updated Property Records. The current total local sales tax rate in Sacramento County CA is 7750. The median property tax on a 32420000 house is 340410 in the United States.

Has impacted many state nexus laws and sales tax collection requirements. Sacramento County has property tax rates that are similar to most counties in California. The current total local sales tax rate in Sacramento CA is 8750.

For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700. The assessment roll reflects the total gross assessed value of locally assessed real business and personal property in Sacramento County as of January 1 2021. Ad Get Reliable Tax Records for Any Sacramento County Property.

Property information and maps are available for review using the Parcel Viewer Application. TaxSecured saccountygov FAQ. What is the sales tax rate in Sacramento California.

The median property tax on a 32420000 house is 220456 in Sacramento County. The sales tax rate for Sacramento County in the state of California as on 1st January 2020 varies from 775 to 875 depending upon in. Postal Service postmark Contact Information.

This is the total of state county and city sales tax rates. The California state sales tax rate is currently. The December 2020 total.

The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate of 068 of property value. As far as all cities towns and locations go the place with the highest sales tax rate is Rancho Cordova and the place with the lowest sales tax rate is Antelope. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information.

Look Up an Address in Sacramento County Today. Compilation of Tax Rates by Code Area. To review the rules in California visit our state-by-state guide.

The Assessors office electronically maintains its own parcel maps for all property within Sacramento County. This is the total of state and county sales tax rates. Did South Dakota v.

Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. So how does the Sacramento county property tax rate differ from the state and national rates. This is primarily a budgetary exercise with entity managers first estimating yearly spending targets.

The one with the highest sales tax rate is 94207 and the one with the lowest sales tax rate is 95836. T he tax rate is. The median property tax on a 32420000 house is 239908 in California.

This is mostly due to the general tax levy of 1. The County sales tax rate is. Some property owners in San Diego City have a 117461 tax rate while some in Chula Vista have a rate of 114221.

A composite rate will generate counted on total tax revenues and also reflect each taxpayers bills amount. 6 rows The Sacramento County California sales tax is 775 consisting of 600 California state sales. 5 rows The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025.

With market values established Sacramento along with other county governing districts will determine tax rates independently. The 2018 United States Supreme Court decision in South Dakota v. A county-wide sales tax rate of 025 is.

The California sales tax rate is currently. How much is the documentary transfer tax. Whether you are already a resident or just considering moving to Sacramento County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Sacramento County collects relatively high property taxes and is ranked in the top half of all counties in the United States by. Learn more About Us.

View the E-Prop-Tax page for more information. 36 rows The Sacramento County Sales Tax is 025. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Learn all about Sacramento County real estate tax. The most populous zip code in Sacramento County California is 95823.

This means that the Sacramento county property tax rate is between California and the national average. July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519 increase over last year. In comparison some Los Angeles residents have tax rates around 119302.

The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. The Sacramento County sales tax rate is. How much is county transfer tax in Sacramento County.

The Sacramento sales tax rate is. Box 508 Sacramento CA 95812-0508 Please ensure that mailed payments have a US. 55 for each 500 or fractional part thereof of the value of real property less any loans assumed by the buyer.

California S Sales Tax Rate Has Grown Over Time Econtax Blog

This Girl Plays Rough Shirt In 2022 Mens Tshirts Girls Play Print Clothes

Women Make 3 Key Investing Mistakes Investing Start Investing Bond Funds

Housing In Infrastructure Bill Real Estate Agent And Sales In Pa Anthony Didonato Broomall Media Delaware Coun Infrastructure Sale House Real Estate News

November Home Prices Rose 9 5 One Of The Highest Gains On Record Case Shiller Says Moving To Idaho House Prices Sacramento County

Cypress Texas Property Taxes What You Need To Know

Nena Co Morocco Sonia On Mercari

Homes Are Selling 8 Days Faster This Spring Says Realtor Com Real Estate News Marketing Housing Market

Tax Rates Cross Creek Ranch In Fulshear Tx

Strategic Relocation How To Find A Safe Haven For Survival Amazing Maps Imaginary Maps Survival

California California U Pick Farms County Map California Map California

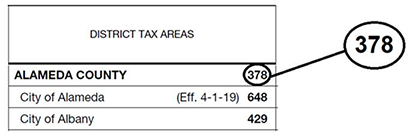

Information For Local Jurisdictions And Districts

Property Taxes Department Of Tax And Collections County Of Santa Clara

Levelling Home Sales Luxury Estate Level Homes Estates